Own Rental Properties Without the Hassle

Easily invest in income-generating real estate, earn passive income, and monitor your returns — all from one platform.

Own Rental Properties. Minus the Hassle.

Easily invest in income-generating real estate, earn passive income, and monitor your returns — all from one platform.

About Us

Fundvate was founded with a clear mission: to empower entrepreneurs by making business funding and growth support more accessible, transparent, and effective. Our team is made up of startup operators, funding experts, and product builders who deeply understand the obstacles founders face when launching and scaling a business.

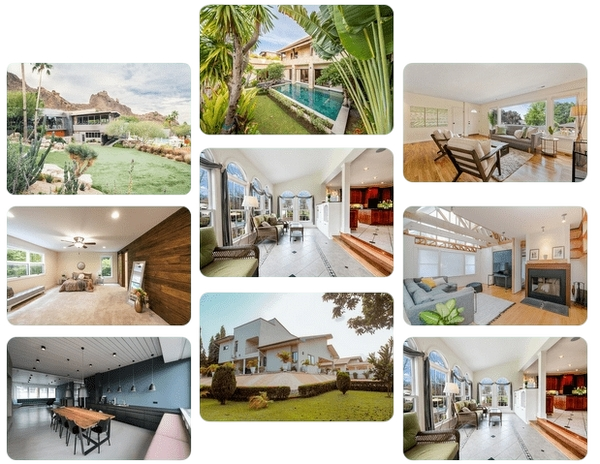

Featured Properties

30 Homes by Brickless

- Lehigh Acres, FL

- $8.7M Total Capitalization

- $3.15M Equity

- Term: 5 years

- Target IRR: 17%

Palm Bay Homes USA

- Palm Bay, FL

- $10M Total Capitalization

- $4M Equity

- Term: 3 years

- Target IRR: 21%

SFR Homes Fund

- Single-Family Home

- Florida

- Delivery July 2025

- Coming Soon

Easy Access to Real Estate Investment

Own income-generating rental properties, earn passive income, and build long-term wealth—without the stress of managing them yourself.

Fractional Ownership, Full Potential

Invest in rental properties with low minimums. No hefty upfront costs—just smart, accessible investing.

Earn Steady Income & Enjoy Long-Term Growth

Receive consistent rental income while benefiting from property value appreciation over time.

Own the Property, Skip the Landlord Duties

Enjoy all the benefits of ownership without dealing with tenants, repairs, or day-to-day operations.

Full Transparency, Always

Access real-time performance data, clear financials, and complete property insights before you invest.

Stake Your Share & Earn Return

Own a share, earn your share, and take the first step toward building a strong real estate portfolio.

Frequently Asked Questions.

Fundvate is a real estate investment platform focused on acquiring and managing single-family rental homes. Operating under SEC Regulation D (Rule 506(c)), it offers accredited investors access to income-producing properties—without the hassle of being a landlord.

Only accredited investors can invest under Rule 506(c). To qualify, an individual must meet one of the following criteria:

Earn at least $200,000 annually (or $300,000 with a spouse) for the last two years, with expectations of the same this year

Have a net worth of $1 million or more, excluding the value of their primary residence

Yes. Fundvate requires a minimum investment amount, which may vary depending on the specific offering. Full details are outlined in the Private Placement Memorandum (PPM).

To remain compliant with SEC regulations, Fundvate:

Verifies the accredited status of all investors before accepting funds

Shares full disclosures via a Private Placement Memorandum

Files necessary documentation, such as Form D, with the SEC

All investments carry some risk. Key risks include:

Market fluctuations affecting property values

Rental vacancies impacting cash flow

Changes in housing regulations

Fundvate mitigates these risks through in-depth market research, professional property management, and portfolio diversification.

Yes. Investors receive cash flow distributions based on the net rental income generated by the properties. The timing and amount may vary depending on factors such as tenant occupancy, operational costs, and lease terms.

Investments are typically structured as equity ownership in either the real estate itself or an LLC that holds the properties. Specific details, including investor rights and profit-sharing terms, are included in the PPM and operating agreement.